In this article, Paul Zubrinich, Chief Marketing Officer at Optalert, provides us with a detailed look at how automotive OEMs navigate the complex technology landscape. Let's take a look...

In the last two months I have spoken with dozens of senior decision makers, engineers, and strategists across leading European, Japanese, and U.S. automakers. Some of these were formal interviews and others informal. Nearly all contributors were prohibited from speaking on behalf of their company and I have thus preserved their anonymity.

I coded and synthesised all insights down to the dominant trends. In this piece, I summarise the key themes that emerged, providing a detailed look at how automotive OEMs navigate the complex technology landscape.

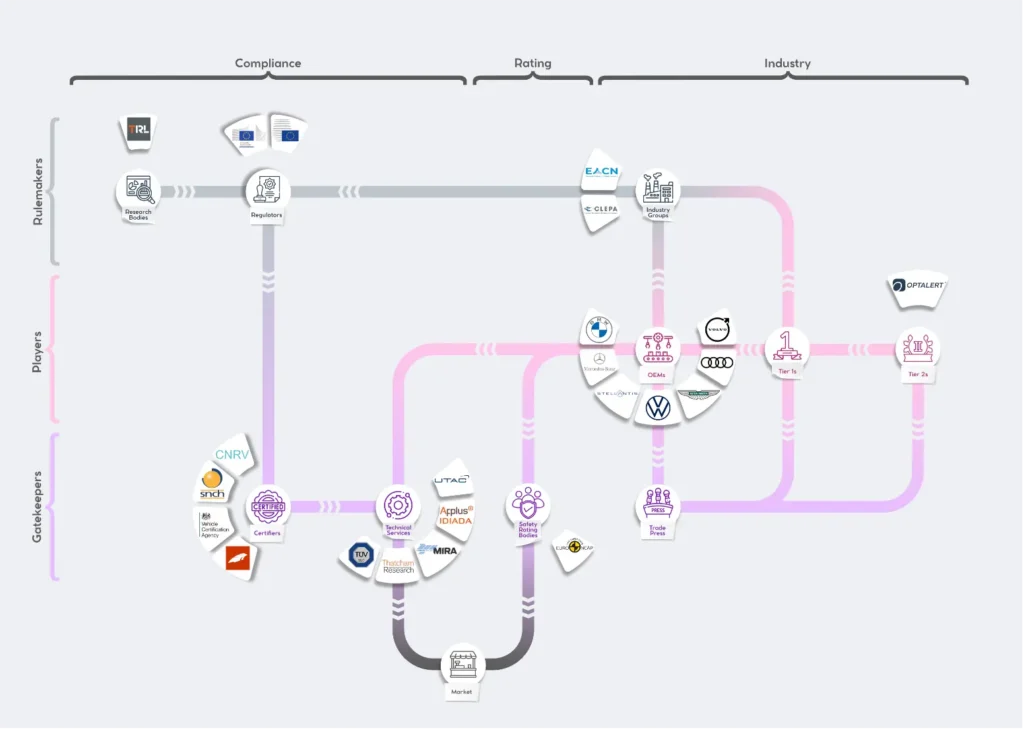

Figure 1. The European automotive ecosystem is a complex network made up of rulemakers, players, and gatekeepers, spanning compliance, rating, and industry.

There are broadly two types of decision-maker.

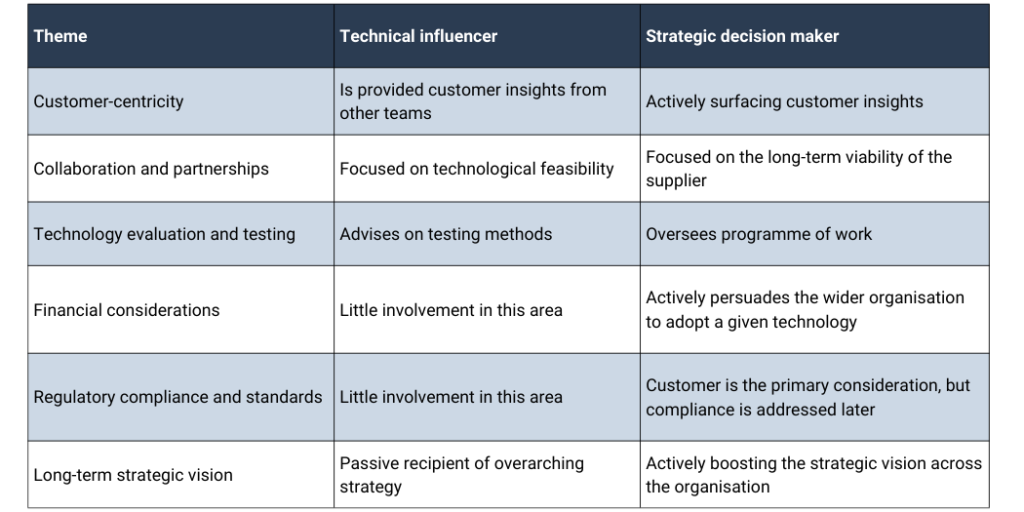

The interviewees could generally be classified into two broad groups: technical influencers and strategic decision makers.

Technical Influencers

Technical influencers are often subject matter experts who research, build, and integrate the various technologies that go into the vehicle.

They have words like “engineer”, “analyst”, “researcher”, and “product owner” in their job titles, as well as references to specific features within the vehicle, such as “infotainment”, “connected vehicle”, “cybersecurity”, or “DMS”.

Their outlook is on technology they can put in the vehicle in around five years, but they also need to select platforms and suppliers that will reliably have at least a 15-year life including support and upgrades. They often work in agile teams that select and integrate technologies into the vehicle. Technical influencers tend to be closer to the innovation ecosystem and adopt a lens focused on pushing technology to market.

Strategic Decision Makers

Strategic decision makers are provided with a range of information from subject matter experts and ultimately make the decision on what goes into the vehicle.

They have words like “strategy”, “innovation”, “planning”, and “manager” in their job titles. The time horizon of their thinking is 10 years or more.

They spend a lot of their working day attending planning meetings, compiling customer insights, preparing presentations, and facilitating the flow of information through the organisation. Strategic decision makers tend to be closer to the customer and adopt a lens focused on the customer pulling innovation through the pipeline.

What themes emerged?

I identified six distinct themes:

Customer-Centricity

Across the board, the automakers cited end users as their “true north” and emphasised the importance of being customer-centric. They acknowledged the pivotal role of customer insights, preferences, and demands in shaping their technology roadmaps. This generally came from the strategic decision makers and informed priorities at the technical level. All OEMs strive to include the voice of the customer in decision-making at every level.

Collaboration & Partnerships

Another prominent theme, and something familiar to all of us at InCabin, was the significance of collaboration and partnerships. Automakers recognise that they cannot develop all technologies in-house and often seek external collaborations to bridge the gaps. In selecting partners and their technologies, automakers consider a range of factors:

- Popularity: Are other OEMs using this technology (this is a plus)?

- Customer impact: Will this technology address what customers want?

- Long-term support: How will the supplier be able to support the technology over the next 10 or 15 years?

- Long-term solvency: Does the supplier have a stable long-term financial outlook? Will they be around in 10 or 15 years to offer support and updates as needed.

- Privacy and security: What vulnerabilities could emerge and how can we mitigate them?

- Modularity: Are we at risk of getting locked into a technology that will fall behind competing options?

- Interoperability: Is the technology easy to integrate and maintain?

- Future trajectory: Is there potential for expansion of the technology’s impact or is it narrowly constrained in a certain area?

Technology Evaluation & Testing

Business analysts and others subject potential technologies to rigorous evaluation and testing processes around both functional and non-functional requirements. From simulated environments and controlled testing facilities to extensive real-world trials, automakers are increasingly vigilant in evaluating the safety, efficiency, and durability of new technologies before integrating them into their vehicles.

Financial Considerations

Automakers are keenly aware of the financial implications of adopting new technologies and strive for a balance between innovation and cost-effectiveness. Strategic decision makers revealed a careful evaluation of the ROI associated with technology investments, taking into account factors such as manufacturing costs, supply chain considerations, risk of future price increases, and potential revenue streams.

Regulatory Compliance & Standards

Surprisingly, compliance with regulatory requirements and industry standards is less of a critical aspect in the earlier stages. The customer is front of mind and GSR compliance or Euro NCAP ratings are rarely considered when first appraising a given technology. Interviewees noted that they are often members of standards-setting bodies and other industry groups. In turn, most of the laws and standards that emerge have had comprehensive input from the automakers themselves. Few of these are top-down mandates from regulators and standards setting bodies. Rather, there has been a lengthy bottom-up process of automakers shaping how the industry will tackle issues around safety, emissions, cybersecurity, and data privacy.

However, this emphasis on regulatory compliance does influence the selection and implementation of tier 1 suppliers and other partners at later stages. In some cases, strategic decision makers had even brought an entire system to market that underperformed in real-world conditions, prompting them to switch suppliers in later versions.

Long-Term Strategic Vision

At the more senior level, an automaker develops a long-term strategic vision, which ripples down through the organisation influencing all technology decisions. Dedicated research teams anticipate future trends, emerging technologies, and changing consumer preferences and behaviours. It goes beyond what customers are saying today and involves forecasting what they will want in the future. This forward-thinking approach involves constant monitoring of market dynamics, technology advancements, and competitive analysis, and can be seen as a competitive advantage in and of itself.

It is important to note that this varies significantly across different OEMs. On one end of the spectrum are the new breed of mission-driven U.S. automakers, wedded solely to electric vehicles, laser-focused on autonomous driving, and envisaging the car as more of a digital product with frequent over-the-air (OTA) updates. Conversely, the legacy automakers I spoke to were far less driven by imposing an internal vision on the world, and more oriented around consumer demand and providing stability and dependability with OTA updates every six to 12 weeks.

How can we better serve automakers and their customers?

Table 1. Across each of the six themes, the technical influencers and strategic decision makers emphasise slightly different areas.

In general, the interviewees across automakers were quite consistent in what factors they used to make technology decisions and there were very few conflicting statements. However, in practice we sometimes see these factors weighted differently within different OEMs. For example, there are interesting developments taking place in owning the in-vehicle experience and automakers appear divided on a path forward. General Motors appears to be making a play to cut Apple CarPlay out of the cockpit to give control of the user experience back to automakers. The future will show if this succeeds.

It is useful for all of us to be aware of how automakers strike a balance between customer needs, partnerships, technology evaluation, financial considerations, compliance, and maintaining a long-term strategic vision. And we should endeavour to understand which areas are more important for each individual with whom we interact. Ofttimes, a large portion of people within a large organisation can feel as though they are an outsider, attempting to pull it in a certain direction, when really the company is a sum of all their competing perspectives.

By understanding these trends, technology firms and stakeholders in the automotive industry can better position themselves as partners and providers of innovative solutions to automakers. I hope the insights above have provided many of you with something interesting to ponder. And I wish everyone at InCabin Brussels a fantastic show.

If you would like to schedule time to meet the Optalert team at the show, you can book a time slot at this link: https://bit.ly/3Buj5T3